Ethereum has shifted its mechanism from Proof of Work (PoW) to Proof of Stake (PoS) on September 15th.

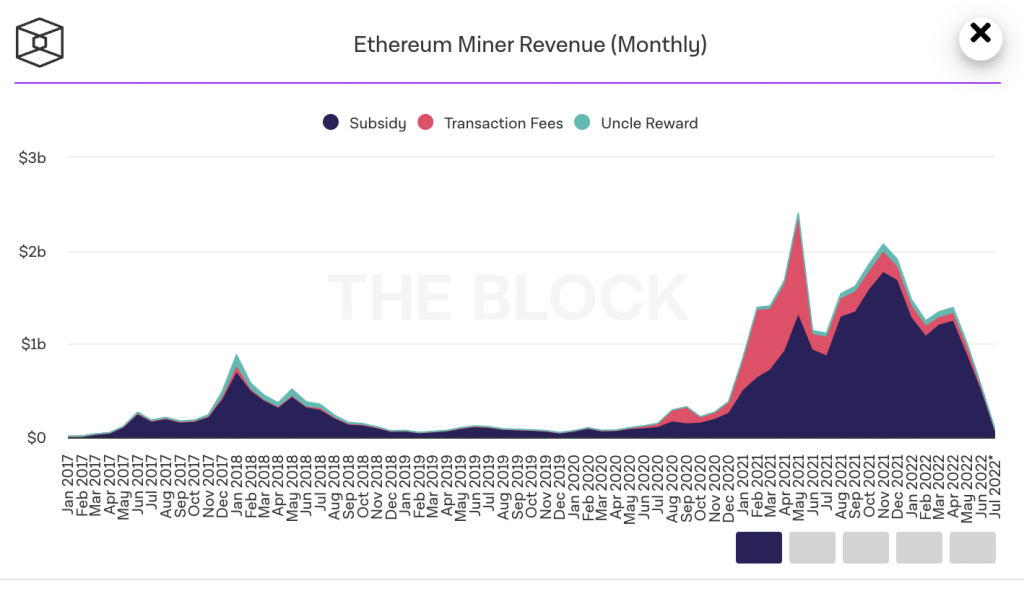

Ethereum’s reliance on PoW powered by GPUs created a globally distributed mining industry which is estimated to be worth USD 19 billions in 2021. Industry participants range from individuals mining on a small rig to publicly listed miners operating large mining farms.

Ethereum has already switched to the PoS model, which will allow transactions to be validated based on staking instead of computational power as in the PoW mechanism. Thus, if the transition to PoS succeeds, Ethereum miners will be made obsolete.

How does Ethereum Merge affect miners?

For many people, mining is simply a hobby since it gives miners satisfaction of passively earning crypto from their computers, not their full-time jobs. Therefore, the merge of Ethereum will not have much impact on their earnings. For those who consider mining a business and made heavy investments in mining tools, the transition seems to be a barrier.

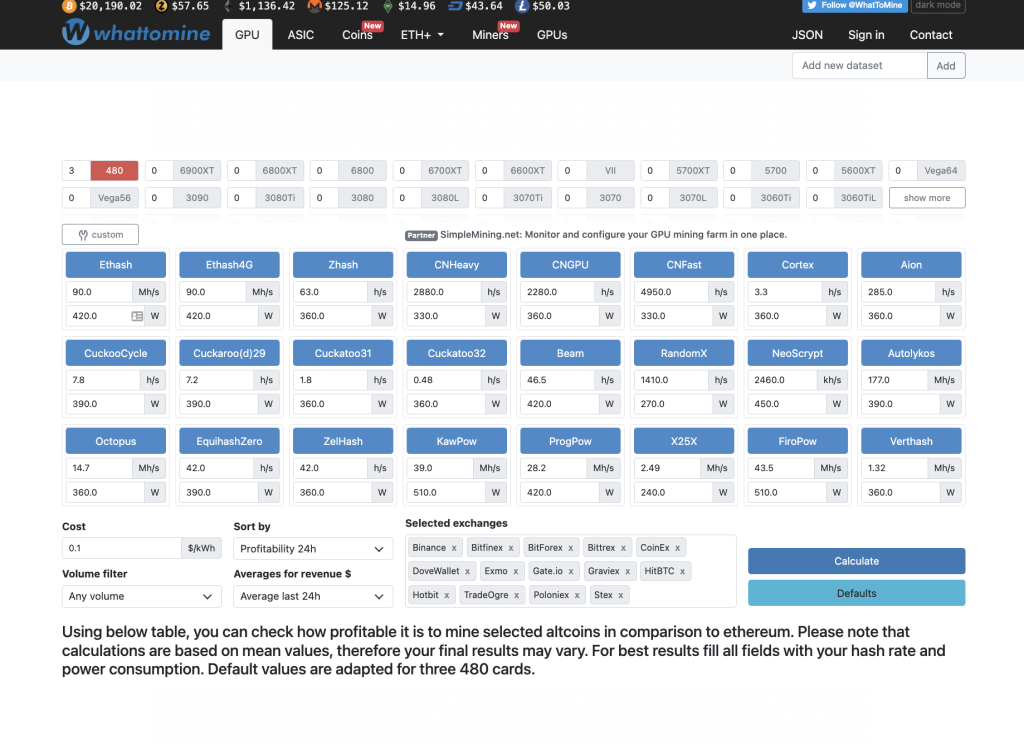

With Ethereum moving away from PoW, both types of miners are left wondering what other PoW coins besides Ethereum are out there to profitably mine.

You can visit the website WhatToMine.com to look up PoW-based coins as well as find out the most profitable coins to mine.

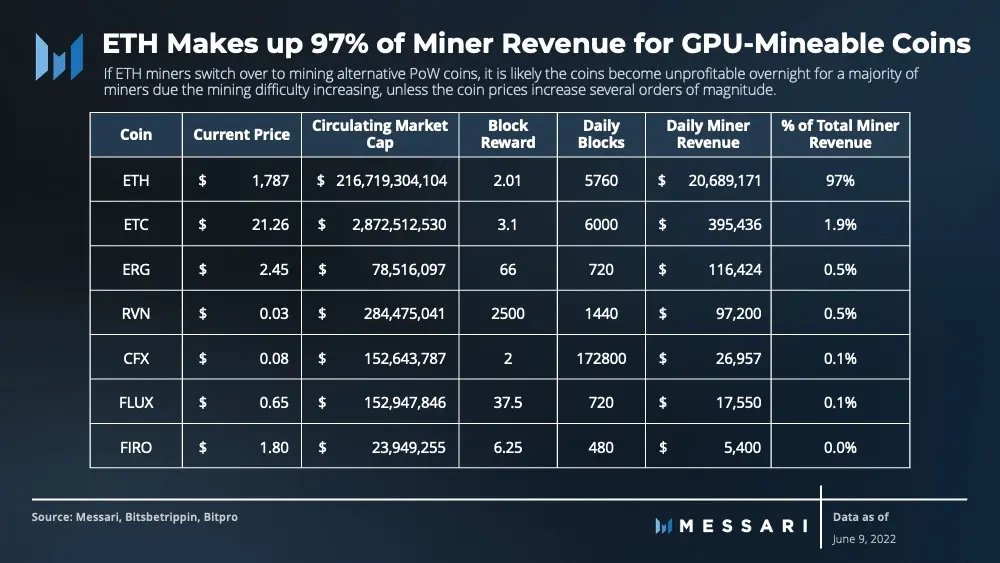

The problem with miners switching from mining ETH to alternative PoW coins is that the market size of these coins is nowhere near Ethereum’s. The total GPU-mineable coin market cap excluding Ethereum is currently around $4.1 billion while ETC accounts for 1.9% of the total GPU miner revenue. This demonstrates how small the GPU-mineable coin market is without Ethereum.

Source: Messari

Besides, if Ethereum GPU miners were to flood into alternative networks overnight, it would drastically drive the mining difficulty up and push a majority of miners out of the profitability range due to high energy charges. Alternative PoW coins are just sufficient for a small number of users.

What should Ethereum miners do post Merge?

Pivoting from mining to a data center-oriented business

While small miners might easily pivot after the Merge, larger miners with thousands of mining rigs have a more difficult decision to make due to the large capital investments made into mining hardware, energy consumption, maintenance, power-related infrastructure, etc. In this case, becoming compute providers for some companies such as Amazon Web Services, Web3, Google ADS, etc. is a good option for large-scale miners.

Providing compute to Web3 protocols

The purpose of Web3 is to create the internet we know today on open, decentralized, and permissionless protocols, allowing users to own digital assets and enjoy various outstanding features that will be developed soon on Web3. For this to become a reality, high-performance compute is required to build massive infrastructure for handling the heavy workloads on Web3. This is an opportunity for miners to change the use of their GPUs to a handful of Web3 protocols including:

- Render: the network allows anyone with a modern GPU to provide their rendering power to anyone who needs it such as artists, designers, and researchers.

- Livepeer: the network offers a marketplace between encoding providers (the supply side) and app developers who need video streaming services (the demand side). Web3 videos are extremely resource-intensive, requiring high-performance GPU computing to upload and process.

- Akash: the network is a secure, transparent and decentralized cloud marketplace that connects users looking for compute with providers who have extra compute capacity. Akash aims to integrate a GPU marketplace into its platform, which will allow the network to handle data-intensive workloads, hence maximizing users’ compute capacity.

These Web3 protocols will open up more opportunities for miners to earn new revenue post Merge. In addition, there will be a lot of technology companies investing in the internet and blockchain in the future, proving these protocols to be an integral part of the crypto market.

Selling Ethereum GPUs and switching to PoS

Large-scale miners can continue to mine ETH by selling their GPUs and become a validator on Ethereum’s network. However, this PoS-based network requires validators to stake a minimum of 32 ETH in order to run a validor node, which is a challenge for most miners. But now, there are many mining facilities that you can partner with to mine ETH, but you have to check the credibility of those facilities to avoid hack, scam, etc.

Conclusion: after the Merge, the CPU mining may collapse, and only a small number of tokens still apply the PoW mechanism in mining.

Through this blog, Jade Forest hope that this article has helped you understand how miners can make the most of their CPUs after Ethereum merges.